The Israeli real estate market is currently in a state of upheaval, marked by heightened uncertainty stemming from the recent war initiated by Hamas on October 7, 2023 and leading to "Operation Iron Swords." This article seeks to unravel the prolonged consequences of the conflict and shed light on the future prospects of the sector.

Before the outbreak of hostilities, the Israeli real estate market was already displaying signs of fatigue. A significant decline in the sales of new homes was noted, ranging from 30% to 90% depending on the areas and types of properties. Moreover, the volume of real estate transactions had decreased by a third compared to the previous year, indicating a concerning downward trend.

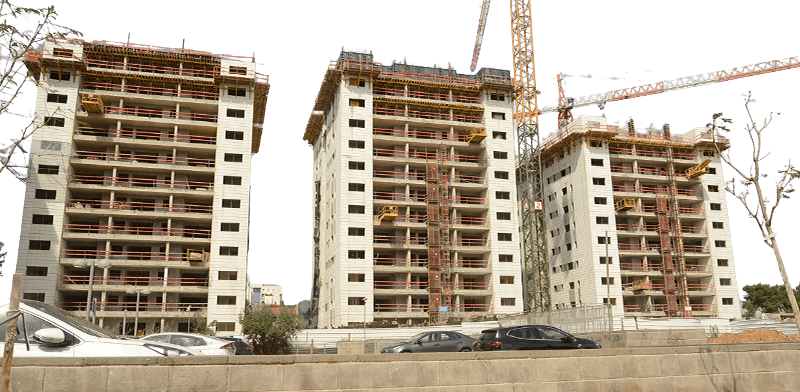

With the onset of the war, the construction sector ground to an almost complete halt. The initial two weeks were marked by an unprecedented absence of real estate transactions in the country's recent history. Even after this period, severe restrictions were imposed, significantly hindering the sector's recovery. This stagnation has led to significant delays in completing ongoing projects and launching new sites.

Furthermore, the disruption of supply chains and the surge in raw material prices have increased construction costs. For example, the prices of steel and cement increased by 20% and 15%, respectively. Coupled with financial uncertainty and rising interest rates, these increases exerted additional pressure on the prices of new homes, exacerbating the challenge of property ownership for many Israelis

Despite these challenges, the demand for housing in Israel has displayed a certain resilience. Following an initial stagnation, signs of recovery have begun to manifest. While the overall sales volume decreased, some regions registered an increase in purchase requests, particularly from expatriates or investors looking to capitalize on temporarily reduced prices. However, this recovery remains uneven and heavily dependent on the country's future stability.

The future of the real estate market in Israel is fraught with uncertainties. Regions close to the Gaza Strip have been particularly affected, with a noticeable drop in property prices in areas such as Sderot, Ashkelon, and Ofakim. Areas that were once thriving have experienced a reversal of their dynamics. In some parts of the south, for instance in Ashdod, prices have dropped by 10-15% since the beginning of the conflict. Conversely, in other southern areas such as Be’er Sheva, the price of rental apartments has increased by approximately 2%, due to the relocation of many residents from cities and kibbutzim close to Gaza.

Presently, the Israeli real estate market stands at a crossroads, grappling with significant challenges and uncertainties. The previous stagnation, exacerbated by the direct and indirect impacts of the war, have given rise to an unprecedented situation. The forthcoming months will be crucial for assessing the long-term impact of these events on the market and observing the responses of homeowners, companies, and regulators to this period of turbulence. It is crucial for policymakers to understand these complex dynamics to facilitate a stable and sustainable recovery of the Israeli real estate market.